Covered Call Example Etrade . when selling covered calls on e*trade, it’s essential to carefully determine the strike price and expiration date of the options to. or you could consider selling a covered call to generate some income while potentially achieving the same result. Rather, the risk in a covered call is. Step by step video of how to sell a covered call with etrade. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: breakdown of what are cover calls are and step by step of how to sell them with etrade. contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. writing a covered call means selling a call option on shares of stock you already own. Explore this slightly bullish to neutral.

from www.wallstreetzen.com

or you could consider selling a covered call to generate some income while potentially achieving the same result. Step by step video of how to sell a covered call with etrade. Rather, the risk in a covered call is. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: breakdown of what are cover calls are and step by step of how to sell them with etrade. writing a covered call means selling a call option on shares of stock you already own. when selling covered calls on e*trade, it’s essential to carefully determine the strike price and expiration date of the options to. contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. Explore this slightly bullish to neutral.

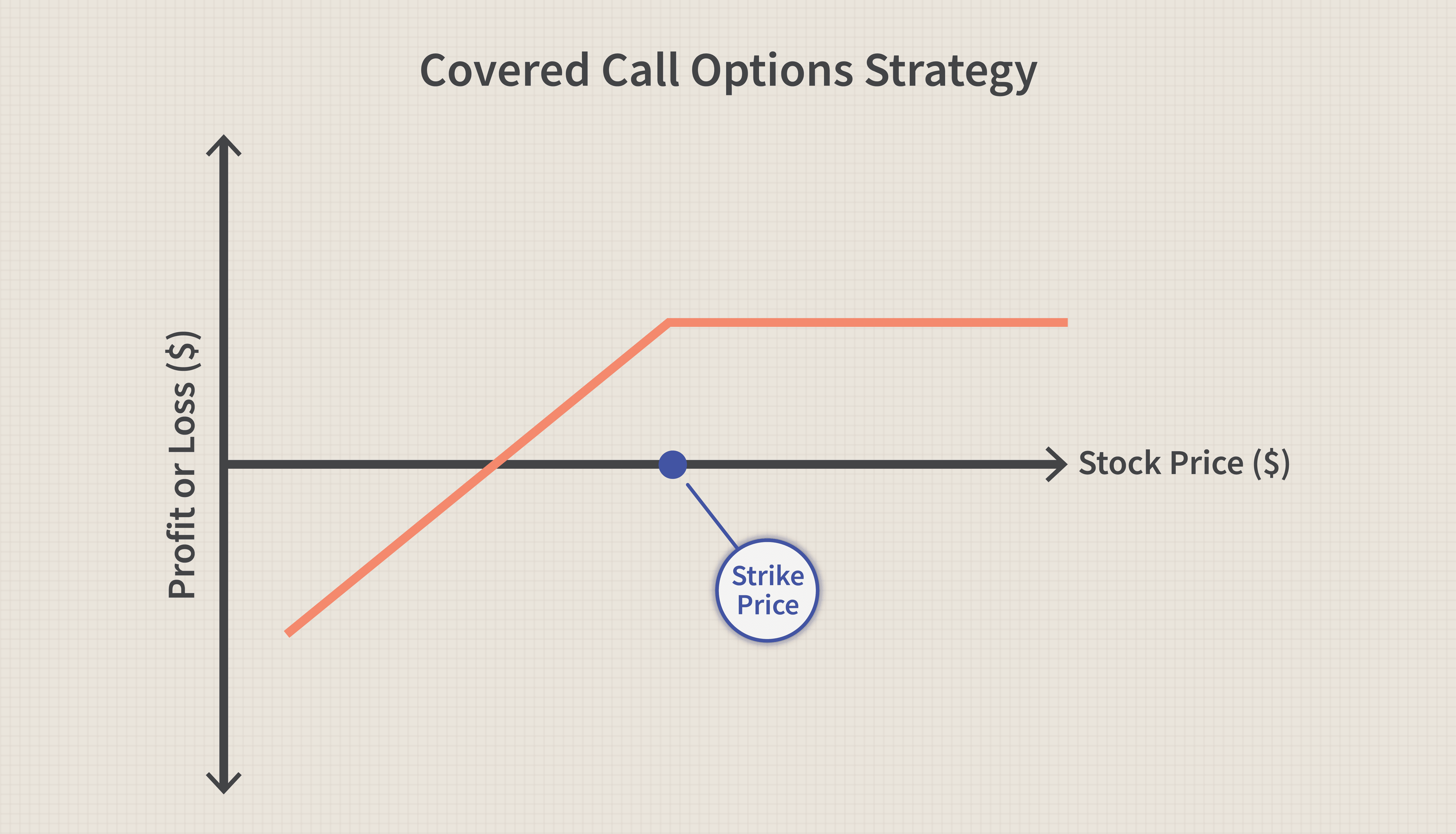

Using Covered Call Option Strategy In Trading Pros, Cons, Basics

Covered Call Example Etrade Explore this slightly bullish to neutral. Rather, the risk in a covered call is. writing a covered call means selling a call option on shares of stock you already own. or you could consider selling a covered call to generate some income while potentially achieving the same result. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: Step by step video of how to sell a covered call with etrade. Explore this slightly bullish to neutral. contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. when selling covered calls on e*trade, it’s essential to carefully determine the strike price and expiration date of the options to. breakdown of what are cover calls are and step by step of how to sell them with etrade.

From www.projectfinance.com

Covered Call Options Strategy Complete Guide w/ Visuals projectfinance Covered Call Example Etrade writing a covered call means selling a call option on shares of stock you already own. contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. or you could consider selling a covered call to generate some income while potentially achieving the same result. breakdown. Covered Call Example Etrade.

From www.youtube.com

Covered Call Options trade on Ford and Fastly on ETRADE platform. YouTube Covered Call Example Etrade Step by step video of how to sell a covered call with etrade. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: breakdown of what are cover calls are and step by step of how to sell them with etrade. or you could consider selling a covered call to generate. Covered Call Example Etrade.

From www.lynalden.com

Covered Calls A StepbyStep Guide with Examples Lyn Alden Covered Call Example Etrade Rather, the risk in a covered call is. when selling covered calls on e*trade, it’s essential to carefully determine the strike price and expiration date of the options to. Step by step video of how to sell a covered call with etrade. Explore this slightly bullish to neutral. how to sell covered calls on e trade (in under. Covered Call Example Etrade.

From www.youtube.com

How To Do A Covered Call On Etrade YouTube Covered Call Example Etrade Explore this slightly bullish to neutral. contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. or you could consider selling a covered call to generate some income while potentially achieving the same result. Step by step video of how to sell a covered call with etrade.. Covered Call Example Etrade.

From www.vantagepointsoftware.com

Understanding Options Learning to Sell Time with Covered Calls Covered Call Example Etrade or you could consider selling a covered call to generate some income while potentially achieving the same result. writing a covered call means selling a call option on shares of stock you already own. Rather, the risk in a covered call is. breakdown of what are cover calls are and step by step of how to sell. Covered Call Example Etrade.

From www.youtube.com

Covered Calls Explained The Complete Guide YouTube Covered Call Example Etrade Rather, the risk in a covered call is. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: writing a covered call means selling a call option on shares of stock you already own. or you could consider selling a covered call to generate some income while potentially achieving the same. Covered Call Example Etrade.

From accessibleinvestor.com

What is a covered call? [Infographic] Accessible Investor Covered Call Example Etrade writing a covered call means selling a call option on shares of stock you already own. breakdown of what are cover calls are and step by step of how to sell them with etrade. Explore this slightly bullish to neutral. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: . Covered Call Example Etrade.

From www.strike.money

Covered Call Definition, Trading Guide, and Examples Covered Call Example Etrade or you could consider selling a covered call to generate some income while potentially achieving the same result. writing a covered call means selling a call option on shares of stock you already own. when selling covered calls on e*trade, it’s essential to carefully determine the strike price and expiration date of the options to. Explore this. Covered Call Example Etrade.

From www.youtube.com

Rolling Covered Call on Marvell Tech (MRVL) OTM/ITM Combo (on ETRADE Covered Call Example Etrade Explore this slightly bullish to neutral. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: or you could consider selling a covered call to generate some income while potentially achieving the same result. contrary to popular belief, the risk when selling a covered call is not if the stock price. Covered Call Example Etrade.

From www.youtube.com

How to buy covered call with Etrade (4mins) YouTube Covered Call Example Etrade breakdown of what are cover calls are and step by step of how to sell them with etrade. Explore this slightly bullish to neutral. Rather, the risk in a covered call is. contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. how to sell covered. Covered Call Example Etrade.

From www.wallstreetzen.com

Using Covered Call Option Strategy In Trading Pros, Cons, Basics Covered Call Example Etrade contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. Rather, the risk in a covered call is. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: Explore this slightly bullish to neutral. or you could consider selling a. Covered Call Example Etrade.

From investinganswers.com

Call Option Example & Meaning InvestingAnswers Covered Call Example Etrade when selling covered calls on e*trade, it’s essential to carefully determine the strike price and expiration date of the options to. contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. Explore this slightly bullish to neutral. how to sell covered calls on e trade (in. Covered Call Example Etrade.

From lyonswealth.com

Covered Call Strategy Everything You Need To Know LyonsWealth Covered Call Example Etrade Rather, the risk in a covered call is. contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. Step by step video of how to sell a covered call with etrade. when selling covered calls on e*trade, it’s essential to carefully determine the strike price and expiration. Covered Call Example Etrade.

From www.projectfinance.com

7 Covered Call ETFs and How They Work projectfinance Covered Call Example Etrade writing a covered call means selling a call option on shares of stock you already own. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: or you could consider selling a covered call to generate some income while potentially achieving the same result. Step by step video of how to. Covered Call Example Etrade.

From optionalpha.com

How to Use the Covered Call Option Strategy Covered Call Example Etrade or you could consider selling a covered call to generate some income while potentially achieving the same result. how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: when selling covered calls on e*trade, it’s essential to carefully determine the strike price and expiration date of the options to. breakdown. Covered Call Example Etrade.

From navigationtrading.com

How to Trade A Covered Call Navigation Trading Covered Call Example Etrade contrary to popular belief, the risk when selling a covered call is not if the stock price were to go higher. Step by step video of how to sell a covered call with etrade. writing a covered call means selling a call option on shares of stock you already own. when selling covered calls on e*trade, it’s. Covered Call Example Etrade.

From www.wallstreetzen.com

Using Covered Call Option Strategy In Trading Pros, Cons, Basics Covered Call Example Etrade how to sell covered calls on e trade (in under 1 minute)sell 1 otm covered call: Rather, the risk in a covered call is. writing a covered call means selling a call option on shares of stock you already own. Explore this slightly bullish to neutral. Step by step video of how to sell a covered call with. Covered Call Example Etrade.

From haikhuu.com

Covered Call Strategy for The Full Guide — HaiKhuu Trading Covered Call Example Etrade when selling covered calls on e*trade, it’s essential to carefully determine the strike price and expiration date of the options to. or you could consider selling a covered call to generate some income while potentially achieving the same result. writing a covered call means selling a call option on shares of stock you already own. Rather, the. Covered Call Example Etrade.